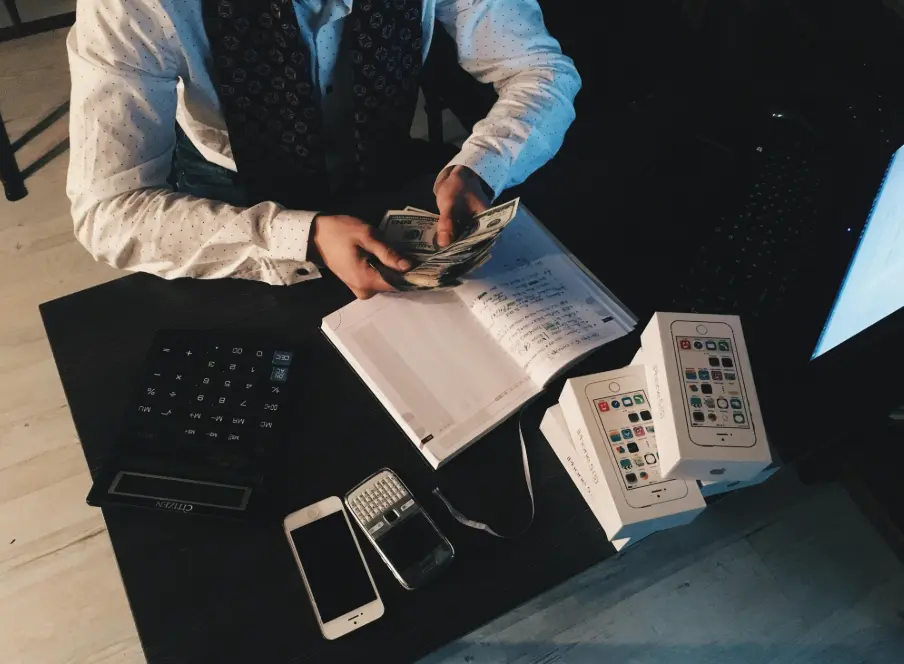

Starting a business is exciting, but here’s a common problem many aspiring entrepreneurs face: money. Many people struggle with balancing startup costs, saving for the future, and avoiding unnecessary expenses. So, how can you avoid this stress? By adopting smart money habits. With the right strategies, you don’t need a big budget to start building something meaningful. Instead, you can learn how to cut costs, save wisely, and invest in the things that matter most for your business growth.

This article shares simple, practical hacks to help you stretch your money further while setting up a strong financial foundation for your business dreams.

Track Every Dollar From the Start

One of the most common mistakes new entrepreneurs make is ignoring the details of their spending. It’s easy to lose track of small costs like software fees, printing expenses, or even frequent coffee runs, but those numbers add up faster than you think. From day one, it’s important to track every dollar. You don’t need expensive software to do this—many free budgeting apps or simple spreadsheets are enough. By tracking expenses, you gain visibility into where your money goes and can identify wasteful habits before they grow into larger problems.

Open a Savings Account Early On

A checking account is designed for frequent transactions, like paying bills or making purchases. A savings account, on the other hand, allows you to set money aside and earn interest over time. For entrepreneurs, having a savings account means creating a safety net for unexpected costs. In the early stages of your business, emergencies are bound to happen, whether it’s a broken laptop or a late payment from a client. With money tucked away in savings, you won’t need to rely on credit cards or loans to cover those gaps.

If you want to know more, articles about checking vs savings accounts from SoFi provide clear comparisons that can help you decide what works best for your situation. Taking this step early builds financial discipline and ensures that your business has reserves to fall back on when challenges arise.

Cut Unnecessary Subscriptions and Services

In today’s digital world, it’s tempting to sign up for every tool, app, or service that promises to make running your business easier. However, subscription costs often pile up without you realizing it. A good practice is to review your subscriptions once a month and cancel anything you haven’t used in the past few weeks. You’ll be surprised how much money you can free up by cutting back. Many times, you can replace paid services with free alternatives or open-source tools that get the job done just as well. The key is to avoid paying for convenience you don’t actually need, especially in the beginning when every dollar counts.

Work With a Lean Budget

Running a business with a lean budget doesn’t mean cutting corners. It means prioritizing the essentials while avoiding unnecessary spending. Assess what you truly need to keep operations going—this may include internet service, essential equipment, or software that directly supports your work. Everything else should be classified as “nice-to-have” until your business grows. Creating a lean budget also keeps you accountable, since you’ll know exactly how much money you’ve allocated for each category.

Use Free Marketing Channels First

Many new entrepreneurs think they need to invest heavily in ads right away, but paid marketing isn’t always necessary in the early stages. Free marketing channels such as social media, networking events, and word-of-mouth can be just as powerful. Building an organic following takes effort, but it often leads to stronger engagement and loyalty than paid campaigns. Social platforms give you a chance to share your story, showcase your products, and connect with potential customers at no cost. By starting with free marketing strategies, you can save money while still building visibility and credibility.

Share Resources and Space

Renting a private office may sound appealing, but it can drain your budget quickly. Co-working spaces offer a smarter alternative. These shared work environments provide internet, meeting rooms, and office amenities. Plus, they also create opportunities to connect with other professionals. Instead of paying for utilities, furniture, and long-term leases, you only cover a flexible monthly fee.

Sharing resources extends beyond office space. You can also split the cost of tools, equipment, or services with other entrepreneurs who have similar needs. For example, sharing accounting software or design tools with a partner can save you both a significant amount of money. The key is to focus on collaboration rather than isolation. By pooling resources, you reduce your expenses while also opening doors to valuable networking opportunities.

Handle Basic Tasks Yourself (Until You Can Outsource)

In the beginning, outsourcing every task might seem like the best way to save time, but it can quickly become expensive. Instead, consider handling some of the basics yourself until your business starts generating consistent income. For instance, you can manage simple bookkeeping using free templates, set up a basic website with affordable platforms, or run your own social media accounts.

There are countless tutorials and free resources online to help you learn these skills. While you may not be an expert at first, doing these tasks yourself helps you understand your business better and keeps costs under control. Over time, once you’ve built up steady revenue, you can choose to outsource the tasks that require professional expertise. This way, you only spend money when it truly makes sense.

Reinvest Your Profits Wisely

When your business begins generating profits, it’s tempting to spend the extra money on personal rewards or non-essential upgrades. While celebrating small wins is important, reinvesting profits into your business should be the priority. This might mean upgrading equipment, expanding marketing efforts, or setting aside funds for future growth opportunities.

Reinvestment doesn’t just support expansion—it also builds financial stability. By saving part of your profits, you prepare for slow periods, unexpected challenges, or opportunities that require quick action. The most successful entrepreneurs understand that profits aren’t just a measure of success; they’re also a resource for building stronger foundations.

Money-saving hacks aren’t just short-term fixes—they create long-term habits that strengthen both you and your business. Every choice you make with your finances shapes the future of your entrepreneurial journey. By being intentional with your money, you give your business the best chance to grow without constant financial stress. In the end, success isn’t about how much you spend—it’s about how wisely you manage what you have.

Also Read-Data Science Innovations Transforming the Fintech Landscape